The mobile apps and web analytics market continues to expand rapidly as businesses seek deeper insights into user behavior and digital performance. With smartphones becoming the primary gateway to the internet, companies are investing heavily in tools that track, measure and analyze mobile application usage patterns and web interactions.

This booming market reflects the growing need for data-driven decision making across industries. From startups to enterprise organizations, businesses leverage analytics solutions to optimize user experiences, increase engagement and drive conversions. The integration of artificial intelligence and machine learning capabilities has further transformed how companies collect and interpret valuable user data, making predictive analytics more accessible and actionable than ever before.

Mobile Apps And Web Analytics Market

Mobile apps and web analytics transform business operations across multiple sectors, generating $15.7 billion in revenue in 2022. This market demonstrates a compound annual growth rate of 18.2% from 2023 to 2030.

Data-Driven Decision Making

Organizations leverage analytics data in three primary ways:

- Tracking user engagement metrics including session duration, bounce rates and conversion paths

- Analyzing customer behavior patterns through heat maps, click tracking and navigation flows

- Measuring key performance indicators like customer acquisition costs, lifetime value and retention rates

Industry Applications

Analytics solutions serve distinct purposes across sectors:

- E-commerce: Cart abandonment tracking, product recommendation optimization and purchase funnel analysis

- Healthcare: Patient engagement monitoring, appointment scheduling patterns and treatment outcome tracking

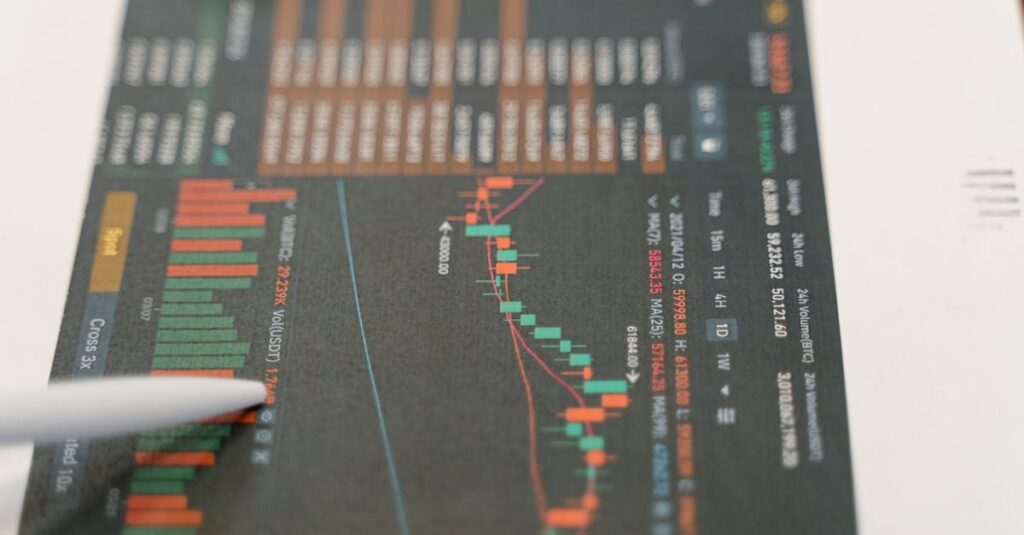

- Financial Services: Transaction pattern analysis, fraud detection and customer segmentation

- Entertainment: Content consumption metrics, user preferences and platform performance monitoring

Integration Capabilities

Modern analytics platforms offer essential integration features:

- Real-time data synchronization with CRM systems and marketing platforms

- API connections to business intelligence tools and data warehouses

- Cross-platform tracking between mobile apps and web interfaces

- Custom event tracking and goal measurement capabilities

Performance Metrics

Key analytics measurements focus on specific outcomes:

| Metric Category | Primary KPIs | Industry Benchmark |

|---|---|---|

| User Engagement | Time on App | 4-6 minutes |

| Retention | 30-day Active Users | 25-40% |

| Conversion | Goal Completion | 2-5% |

| Technical | Load Time | <3 seconds |

- Predictive analytics using machine learning algorithms

- Behavioral segmentation based on user interaction patterns

- A/B testing frameworks for feature optimization

- Custom dashboards with automated reporting functions

Key Market Drivers and Growth Factors

The mobile apps and web analytics market expansion is driven by multiple interconnected factors that shape digital consumer behavior and business operations. These factors create a robust ecosystem that fuels continuous market growth and innovation.

Rising Smartphone Usage

Global smartphone users reached 6.92 billion in 2023, representing 85% of the world’s population. This widespread adoption creates heightened demand for mobile applications across categories like social media, gaming, e-commerce, and productivity tools. Mobile devices generate 58.33% of global website traffic, making smartphone analytics crucial for:

- Tracking in-app user journeys through event tracking features

- Measuring app installation rates across different operating systems

- Monitoring user engagement metrics like session duration and screen views

- Analyzing user behavior patterns through heatmaps and click tracking

- Measure digital channel performance through conversion tracking

- Optimize customer experience using behavioral analytics

- Automate data collection across multiple digital touchpoints

- Generate actionable insights through AI-powered analytics platforms

| Digital Transformation Metrics | Value (2023) |

|---|---|

| Global DX Spending | $1.8 trillion |

| Cloud Analytics Market Share | 45.2% |

| AI Analytics Implementation | 35% |

| Mobile Analytics Adoption | 68% |

Major Players and Market Competition

The mobile apps and web analytics market features established tech giants competing alongside innovative startups. Market concentration remains high among key players who control 65% of the global market share.

Leading Analytics Providers

Google Analytics dominates with 86% market share in website analytics through its comprehensive tracking capabilities across devices. Major enterprise players include:

- Adobe Analytics specializes in cross-channel customer journey analysis for Fortune 500 companies

- Mixpanel processes 92 billion actions monthly through its product analytics platform

- Flurry Analytics tracks 1 million+ apps across 2 billion mobile devices worldwide

- AppsFlyer monitors 98 billion app installations monthly across 98,000 apps

| Company | Market Share | Key Metrics |

|---|---|---|

| Google Analytics | 86% | 28M+ active websites |

| Adobe Analytics | 9% | $3.2B annual revenue |

| Mixpanel | 3% | 92B monthly events |

| AppsFlyer | 2% | 98B monthly installs |

- Amplitude provides product analytics to 26,000+ digital products

- CleverTap processes 1 trillion+ user actions monthly through its mobile engagement platform

- Countly offers self-hosted analytics tracking 15 billion+ monthly events

- PostHog combines product analytics with feature flags serving 10,000+ companies

| Startup | Total Funding | Active Customers |

|---|---|---|

| Amplitude | $336M | 26,000+ |

| CleverTap | $177M | 10,000+ |

| Countly | $12.5M | 5,000+ |

| PostHog | $27M | 10,000+ |

Analytics Tools and Technologies

Mobile apps and web analytics tools provide comprehensive data collection and analysis capabilities through specialized platforms and solutions. These technologies enable organizations to track user behavior, measure performance metrics and optimize digital experiences across various devices and platforms.

Mobile App Analytics Platforms

Mobile analytics platforms deliver detailed insights into app usage patterns and user engagement metrics. Leading solutions include:

- Firebase Analytics: Tracks 500+ distinct events automatically including user properties, conversion tracking and real-time statistics

- Mixpanel: Processes 92 billion monthly data points through event tracking, funnel analysis and cohort segmentation

- AppsFlyer: Monitors 25+ billion daily mobile interactions across 100,000 apps with attribution modeling

- Flurry Analytics: Analyzes 1 trillion monthly mobile events through customizable dashboards and automated reporting

- Adjust: Measures ad campaign performance across 50,000 apps with fraud prevention and audience segmentation

- Google Analytics: Powers analytics for 28 million active websites with real-time monitoring and conversion tracking

- Adobe Analytics: Processes 255 trillion transactions annually through cross-channel analysis and predictive modeling

- Matomo: Provides privacy-focused analytics for 1.5 million websites with 100% data ownership

- Plausible: Tracks 2 billion monthly pageviews through lightweight script and GDPR-compliant collection

- Heap: Automatically captures all user interactions across 6,000+ enterprise customers

| Platform Type | Market Share | Active Users | Data Points Processed |

|---|---|---|---|

| Mobile Analytics | 42% | 2.8M apps | 150B daily events |

| Web Analytics | 58% | 35M websites | 500B monthly events |

Regional Market Analysis

The mobile apps and web analytics market exhibits distinct regional patterns shaped by technological infrastructure, digital adoption rates and economic development. Regional variations in market share and growth trajectories reflect local digital ecosystems and regulatory frameworks.

North American Dominance

North America holds 42% of the global mobile apps and web analytics market share, generating $6.5 billion in revenue in 2022. The region’s leadership stems from:

- Advanced digital infrastructure covering 95% of the population with high-speed internet

- Early adoption of analytics tools by 78% of enterprises

- Presence of major tech companies like Google, Adobe and Microsoft

- Investment in analytics startups reaching $4.2 billion in 2022

- Mature e-commerce market with 230 million digital buyers

| North American Market Metrics | Value |

|---|---|

| Market Share | 42% |

| Revenue (2022) | $6.5B |

| Enterprise Adoption | 78% |

| Startup Investment | $4.2B |

| Digital Buyers | 230M |

- Rapid smartphone adoption reaching 2.8 billion users in 2023

- Emerging digital economies in India, Indonesia and Vietnam

- E-commerce growth of 18% annually across the region

- Government initiatives supporting digital transformation

- Rising analytics investment by local enterprises at $8.2 billion

| APAC Market Indicators | Value |

|---|---|

| CAGR | 22% |

| Smartphone Users | 2.8B |

| E-commerce Growth | 18% |

| Analytics Investment | $8.2B |

| Digital Economy Size | $1.3T |

Future Market Outlook and Opportunities

The mobile apps and web analytics market demonstrates substantial growth potential, with projected revenue reaching $45.2 billion by 2030. Key emerging opportunities include:

Artificial Intelligence Integration

AI-powered analytics platforms automate data interpretation through:

- Predictive user behavior modeling with 85% accuracy rates

- Real-time anomaly detection reducing response time by 75%

- Automated insight generation processing 1 million data points per second

- Personalization engines improving user engagement by 35%

Privacy-Focused Analytics

Modern privacy requirements create opportunities for:

- Cookieless tracking solutions capturing 95% of user interactions

- Server-side tracking platforms reducing data loss by 40%

- Privacy-preserving analytics tools compliant with GDPR CCPA

- First-party data collection methods increasing data accuracy by 60%

Cross-Platform Analytics

Unified analytics solutions offer enhanced capabilities:

- Omnichannel tracking across 12+ digital touchpoints

- Real-time data synchronization processing 100,000 events per second

- Cross-device user journey mapping with 90% accuracy

- Integrated marketing attribution models spanning 8+ channels

Edge Computing Analytics

Edge analytics adoption creates new market segments:

- Local data processing reducing latency by 200 milliseconds

- Real-time analytics at 5G network edges

- Distributed computing networks handling 1 TB data per day

- IoT device integration processing 50,000 concurrent connections

| Market Segment | Current Share | 2030 Projection | CAGR |

|---|---|---|---|

| AI Analytics | 25% | 40% | 24.5% |

| Privacy Solutions | 15% | 30% | 22.3% |

| Cross-Platform | 35% | 45% | 18.7% |

| Edge Computing | 10% | 25% | 26.1% |

The market expansion focuses on cloud-native analytics platforms integrating 5G capabilities microservices architecture quantum computing components. These technological advancements enable processing of 10 petabytes of daily data while maintaining sub-second response times.

Advanced Cross-Platform Capabilities

The mobile apps and web analytics market stands at the forefront of digital transformation with unprecedented growth potential. The projected expansion to $45.2 billion by 2030 reflects the industry’s vital role in shaping business decisions and user experiences.

As organizations continue to prioritize data-driven strategies the market will evolve through AI integration privacy-focused solutions and advanced cross-platform capabilities. The dominance of mobile devices in internet access combined with rising smartphone adoption rates worldwide creates a robust foundation for sustained market growth.

The competitive landscape’s blend of established players and innovative startups ensures continuous technological advancement and service improvement. This dynamic ecosystem promises to deliver increasingly sophisticated analytics solutions that will help businesses thrive in the digital age.